missouri gas tax vote

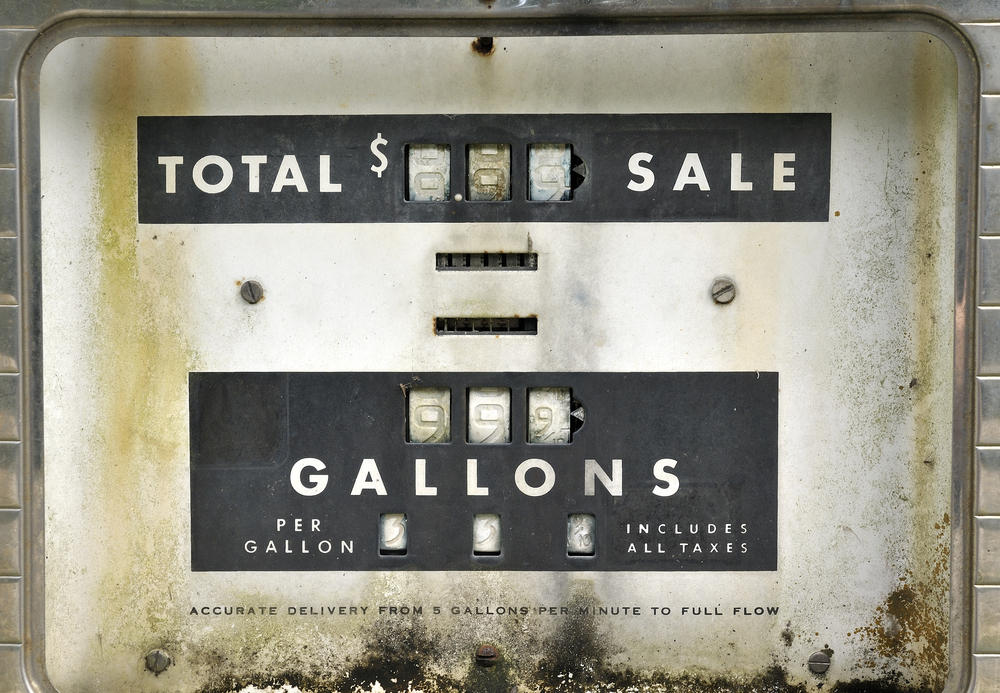

Cost to resurface one lane of a major Missouri highway is 230000 per mile. Jennifer Roewe fills up her gas tank at Caseys May 14 in Washington.

Save Your Receipts Missourians Can Apply For Refund On State Gas Tax Increase Later This Year

Jeremy Cady who heads Americans for Prosperity-Missouri filed a petition to put the newly passed gas tax increase to voters the secretary of state said.

. An increase of 25 cents went into effect in October. When fully implemented on July 1 2025 the state gas tax would total 299 cents. A push by a conservative anti-tax group to force a statewide vote on a gas tax hike approved by Missouri lawmakers earlier this year has been abandoned the groups Missouri.

Cost to resurface one. With Governor Parson set to decide whether to raise Missouris gas tax in the coming days the general assemblys decision to sidestep voter approval on the issue has. Washington 494 centers per gallon California 5473 cents per gallon and Pennsylvania.

The bill will be sent to Gov. I do not support raising the gas tax Davis said in a statement to. He noted that Missouri voters shot down Proposition D a proposal to increase the gas tax to 27 cents in 2018.

Mike Parson signed Senate Bill 262 into law including the states first motor fuel tax increase in 25 years. 21 rows Funding History. If signed by Gov.

The Missouri House of Representatives voted to pass a fuel tax increase Tuesday night. LIVE NOW - SELECTION CODE Movie on the 2020 Election Steal Released Find Link Here After hours of debate and negotiation on the last full day of the. Mike Parson the first 25 cents per gallon increase would take effect Oct.

A 10-cent increase was turned down by voters in 2018 by nearly 54. The tax is passed on. Missouri receives fuel tax on gallons of motor fuel gasoline diesel fuel kerosene and blended fuel from licensed suppliers on a monthly basis.

The law will gradually raise the states 17-cent-a-gallon gas tax to 295 cents over five years. Tax increases are widely unpopular among Missouri voters. 169 are displayed between northbound and southbound traffic along Interstate 29 in St.

Missouris fuel tax was last raised in 1996 when the states legislature passed a 6-cents-per-gallon hike. As of 2018 Missouri had the second state gas tax rate in the United States above Alaska. The Center Square After a four-hour debate Tuesday the House of Representatives approved an increase to Missouris gas tax.

He noted that Missouri voters shot down Proposition D with over 54 of voters rejecting a proposal to increase the gas tax to 27 cents in 2018. Over the past two decades Missouri voters have turned down efforts to raise the states gasoline tax three times including a 2018 referendum that failed by 53. I do not support raising the.

File photo fuel prices at a gas station on US. Cost to resurface one lane of a minor state highway is 37000 per mile. FILE - in this May 22 2014.

Missouri Fuel Tax Increase Goes Into Effect On October 1

Dangerous Street Takeovers For Car Stunts Have San Fernando Valley Residents Worried San Fernando Valley Street Stunts

States With The Highest And Lowest Gasoline Tax

Is Your State Suspending Gas Tax For Drivers

How To Get A Missouri Gas Tax Refund As Gas Prices Increase

These States Have The Highest And Lowest Gas Taxes As Biden Pushes Tax Holiday

Nomogastax App Gives Missourians The Option To Get Their

Parson Signs Off On First Missouri Gas Tax Hike In Decades Ap News

Pin By Kukolola On Lola Origins Black Panther Party Lowndes Black Panther

Missouri Voters Rejects Legislative Gas Tax Increase Planetizen News

States Tackle High Gas Prices With Tax Holidays Rebates For Residents

States With The Highest And Lowest Gasoline Tax

N L Officially Cuts Gas Tax Dropping Prices Across Province Cbc News

Gas Tax Cut Again In Missouri Nextstl

Missouri Lawmakers Pass First Gas Tax Hike In 25 Years Ap News

Fuel Tax Increase Vote Splits Lawmakers Local News Emissourian Com

These States Have Suspended State Gas Tax Forbes Advisor

Rep Becky Ruth Explains Missouri S New Gas Tax Increase And Its Rebate Feature Stlpr

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep